Essential Steps for a Successful 1031 Exchange in 2026

Updated 1/18/2026

Our goal is to help investors stay educated by providing straightforward, unbiased 1031 exchange information for 2026 by providing:

- 1031 Exchange Rules and Real Estate Investing Articles

- 1031 Exchange Information Guide

- Capital Gains Taxes by State

- Tax-Deferred Exchange Timeline Calculator

- Frequently Asked Questions and Answers

1031 tax-deferred exchanges allow investors to defer paying capital gains tax by reinvesting funds from property sales back into their real estate portfolios. Section 1031 Exchanges are a key tool educated investors use to benefit from existing tax regulations and preserve and grow investment capital in any economic cycle.

Important Questions About Your Real Estate Investments & 1031 Exchanges

To get the most out of their on-going education, it’s important for investors to ask themselves three important questions about real estate investing:

- What are the IRS 1031 exchange rules?

- What is my real estate investment timeline?

- Have I researched available 1031 exchange information?

- Does passive investing make more sense than doing everything myself?

1031 Exchange Rules

- Seller must never take possession of funds from the relinquished property

- Replacement property must be like-kind real estate

- Real estate must be used for investment or business, and not be considered stock in trade or personal property

- Property replaced must be of equal or greater value to the property being relinquished

- Title of the relinquished property and the replacement property must be in the same taxpayer name

- Replacement property must be identified within 45 days of closing on the sale of the relinquished property

- Replacement property must be purchased within 180 days of closing on the sale of the relinquished property

Article: Three Most Common Ways Investors Blow Their 1031 Exchange

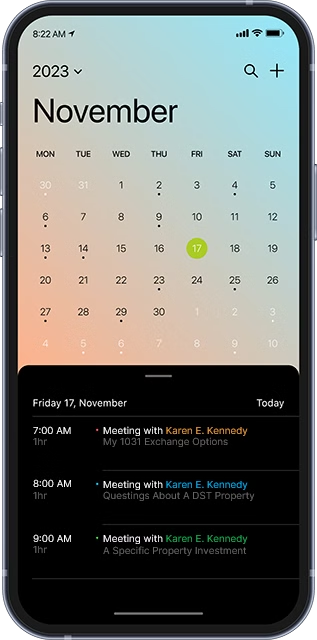

What is My Real Estate Investment Timeline?

A good way of thinking about a timeline for investing in real estate is to consider how important liquidity will be to you 5, 15, and even 30 years or more from now.

Historically, real estate has been an attractive way to build wealth over the long term. The trade-off is that capital invested in real estate is illiquid. Unlike shares of a publicly traded stock, real estate can’t be bought and sold at the push of a button on your computer keyboard.

Because real estate lacks liquidity, investors should understand when they’ll need to turn their investments into cash and identify a real estate investment timeline accordingly.

Have I Researched Available 1031 Exchange Information?

Owning real estate gives a unique combination of three benefits that many other investments do not offer:

- First, investment real estate provides two cash flow streams: short-term through the monthly net income and long-term through the appreciation of the real property when it is sold.

- Second, tax law allows owners of real estate to reduce their annual cash income from the property by deducting a non-cash depreciation expense. This allows investors with positive net cash flow to reduce the amount of taxable income from their real estate investments.

- Third, Section 1031 tax deferred exchanges allow real estate investors who sell a like-kind property and replace it with another piece of real estate to defer paying the tax on any capital gains resulting from the exchange transaction. In our NASIS 1031 Exchange Guide we illustrate how one investor was able to grow the value of his real estate investment portfolio by nearly 70% by deferring the payment of capital gains tax and reinvesting the sales proceeds in like-kind real estate.

Does Passive Investing Make More Sense Than Doing Everything Myself?

Most people begin investing in real estate in their spare time. They purchase a single-family home, rent it out to tenants, and manage the property themselves. That’s a common example of active real estate investing where the owner does everything.

However, when you’re hands-on it’s difficult to scale up and grow a real estate investment portfolio. Active real estate investing takes a lot of time and also limits the type and quality of property that can be invested in.

Passive real estate investing through an experienced real estate sponsor, like NAS Investment Solutions, can enable an investor to save time and expand the available type and quality of investment. By placing capital in a DST or TIC structured vehicle, investors have access to institutional-grade commercial real estate such as multifamily and student housing, and office, medical, warehouse, and industrial flex income property in both primary and high-yield secondary markets.

NAS Investment Solutions’ investment properties have been professionally underwritten and are managed by a team of professionals that have a wealth of experience in managing hundreds of investment properties across the country. DST and TIC real estate investments can offer an attractive 1031 opportunity, which can be precisely sized to meet the investor’s specific needs, and they can also be employed as part of an investor’s strategy to diversify his or her portfolio.